The other day I thought, “Hmm, you know what would be fun? Having my friend The Nonconsumer Advocate do a Meet a Reader post!”

It’s really more of a “Meet a Blogger” post, but Katy does also read my blog, so she qualifies for a Meet a Reader spot.

Here’s Katy!

1. Tell us a little about yourself

Like Kristen, I’m a frugality blogger and have been writing The Non-Consumer Advocate since May 20, 2008. My motto is “Use it up, wear it out, make it do or do without” and as corny as it may sound, I really do try to live by this credo.

My husband and I repair instead of replace and we do the work of figuring out how to live below our means.

Here’s the very first blog post that started it all! My life has changed a lot since then, as my kids are now adults and I retired from my 24-year career as a labor and delivery nurse a scant few months before the pandemic.

Although I’m 100% done with nursing, I’m excited for Kristen to begin her nursing career!

I decided in 2007 to stop buying pretty much anything new and haven’t looked back. Sure there are the occasional situations when I’ve had no choice but to purchase new, (like when the kids needed uniforms for their various sports teams) but it’s the exception rather than the rule. My protest against mainstream consumerism seemed weird 17 years ago, but I’m happy to see that more and more people are taking a critical eye to the shop-shop-shop culture that used to be unquestioned.

My decision to only buy used was considered so bizarre that I was even on The Today Show in 2012 as “Woman buys nothing new in five years!” Like a circus sideshow freak.

You can read my buy used exception list HERE if you’re curious about my purchasing habits. Mostly it’s personal care items and a few things that would give me the ick to buy used — think mattresses, underwear or a harmonica.

2. How long have you been reading The Frugal Girl?

I’ve been a reader since of The Frugal Girl since day one, as I recall Kristen messaged asked for advice about frugal blogging when she was first starting out a couple months after I did. You could say that we grew up together as frugality bloggers. From baby bloggers to seasoned(ish) pros.

Although we’re “online friends,” we actually met up in person when my family visited the D.C. area in 2014 and even toured the Smithsonian Museum together with our six kids!

Here we are all happy, (but sadly out of focus and backlit) in front Julia Child’s kitchen!

And here we are, complete with a 2014-style Instagram filter. (Valencia, maybe?)

Either way, we spent the day chatting like the close friends that we’d become. We text each other frequently and even pop on for the occasional phone call.

Either way, we spent the day chatting like the close friends that we’d become. We text each other frequently and even pop on for the occasional phone call.

3. How did you get interested in saving money?

I’ve always enjoyed the challenge of stretching a dollar, but I didn’t get intense about it until 1998 when I was on maternity leave with my youngest. My mother gave me a copy of “The Tightwad Gazette” and everything clicked into place. I loved Amy Dacyczyn’s creative mindset, how she wrote about “tightwaddery” as a fun challenge instead of a life of deprivation.

I was an absolutely exhausted mother of two littles and working night shift and wanted to just work part-time. I saw that so many RNs were working mothers and full-time employees and still living paycheck-to-paycheck, even though their husbands made bucketloads more money than mine did. I wanted something different.

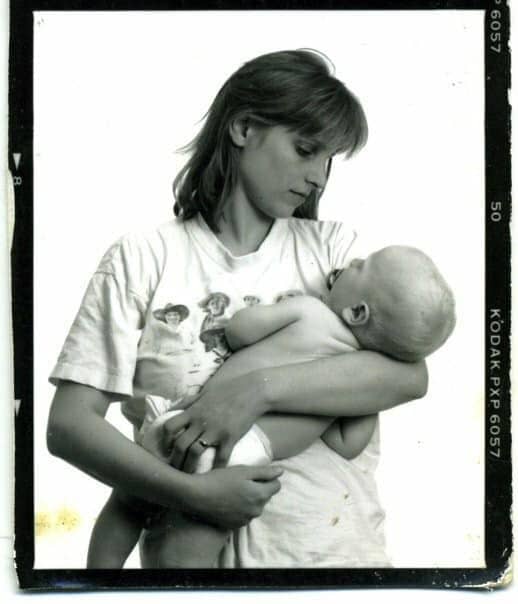

I mean, look at the circles around my eyes in this photo! It’s not eye shadow.

4. What’s the “why” behind your money-saving efforts?

The “why” behind my money-saving efforts have changed throughout the years and I imagine will continue to evolve. Initially, it was to have some financial stability, but it deepened into an understanding of how mindless consumerism is tied to the health of our planet.

Buying a brand new item prompts a replacement to be manufactured from raw materials, buying used does not. Buying used also keeps perfectly good stuff out of the waste stream.

5. What’s your best frugal win?

I wish I had a super cool impressive answer for this question, but I think the bigger picture win is a thousand small frugal wins.

Drinking tap water, holding onto my belongings for an extended period of time, giving and receiving through my Buy Nothing group, repairing our belongings, not being snobby about secondhand things, and generally keeping a wide berth from The Joneses.

Kristen has written many times about the role of contentment in frugality and I think it’s an important aspect of frugality. I don’t need impressive travel or belongings to feel worthy of my space in this world. I’m mostly content with my own semi-scrappy lifestyle.

6. What’s an embarrassing money mistake you’ve made?

I can’t think of any, but that might just be my brain in protection mode.

7. What’s one thing you splurge on?

My husband and I paid for both of our kids to get their bachelor’s degrees. We got some help from family, but it was mostly just us working extra shifts and spending pretty much nothing on ourselves for 5-1/2 years.

My years of knowing how to live on as little as possible came in very handy!

8. What’s one thing you aren’t remotely tempted to splurge on?

Living my life like the average consumer.

I used to bring a Ziploc bag of bulk-purchased instant oatmeal for my night shift meals. One specific nurse thought this was hilarious, but I explained that I was at work “to make money, not spend it.”

That same nurse (now management) wistfully brought this up when I announced my early retirement and joked that maybe she should’ve been bringing oatmeal over the decades like I had.

I don’t embarrass easily, which helps.

9. If $1000 was dropped into your lap today, what would you do with it?

Look up at the sky and ask “Where did this money fall from?” Then I’d deposit it in a high-yield savings account so I could get 5% interest on it.

10. What’s the easiest/hardest part of being frugal?

For me, being frugal suits my nature, which makes it an easy lifestyle. I get more enjoyment from a frugal win than a splurge.

It can be hard to celebrate the $5 savings here and the $30 savings there when life comes at you with an unexpected $3,500 bill. I have no words of wisdom on this except to dust yourself off and keep working the plan.

11. Which is your favorite type of post at the Frugal Girl and why?

It might be self-serving, but I love when Kristen writes her “Five Frugal Things” blog posts.

I enjoy the peek into her daily life, plus the comments section is always a wealth of information. I’ve written thousands of my own “Five Frugal Things” blog posts, so it gives me a tickle when other content creators follow this format.

12. What is something you wish more people knew?

It’s okay to be cheap!

I’m going to climb on my favorite soapbox and defend cheapness. Being cheap gets a bad rap as it’s associated with being ungenerous, self centered and miserly. Unfortunately a lot of people get themselves into financial trouble in order to not appear “cheap.” They give gifts they cannot afford, take vacations on credit, drive vehicles with crushing car payments and make aspirational purchases that put them under water.

I want people to know that it’s perfectly to make the cheap choice if it’s what you can actually afford.

I often tag my Instagram with the hashtag #cheapaf, (I’ll let you guess the meaning of “af.”) because I want people to explore how to find cheap solutions to everyday problems. It’s fun, it’s cheeky and there’s no need to apologize for your cheapness!

13. Is there anything unique about frugal living in your area?

I live in Portland, Oregon, which is great city for frugal minded folks.

There’s a well stocked Goodwill in every neighborhood and people regularly set their unwanted belongings out on their curb for neighbors to look through. (I’ve found a lot of my household belongings this way, as well as items to sell for profit!)

There’s a strong restaurant culture for all budget levels and there don’t seem to be any food deserts. Our low income neighborhoods actually have the best grocery stores. (Winco Foods, which has an impressive bulk food section and consistently lower prices.)

We have tons of parks and green space and the mild weather to enjoy it.

Okay, it’s not perfect. Rent has climbed higher than a lot of people can afford, but that’s certainly not exclusive to Portland.

Kristen, thank you so much for inviting me to share in your “Meet a Reader” series. This was super fun to write up. love you! Mwah!

XXOO

Your friend Katy

P.S. #cheapaf

________________

Katy, thank you! I’m so glad to host you here, and I am forever grateful to you for the inspiration to do Five Frugal Things posts.

We need to get together again and get a better photo of the two of us, without a filter this time. Heh.

I always think of you when I pack lunches to go work at the hospital…I’m always like, “I’m here to make money, not spend money.” So far, I have bought zero hospital food, even from a vending machine.

And I’ve also made it through all my clinical shifts the last year without buying food, so I’m on a pretty good streak.

I have not, however, drunk any of the crappy hospital coffee (like you used to do), because I am not about to make myself a cup of powdered coffee. I’ve just been bringing mine from home. 🙂