Hello everyone! Today we are meeting a reader who has a frugal fail in common with me. 🙂 Here’s Colleen!

1. Tell us a little about yourself

At a cat sanctuary on my honeymoon; more on that later

I worked in a career for about 10 years that took me all over the world, which was an exciting way to start my professional life.

About 5 years ago I decided to change careers, settle into a growing Midwest city, and now I’m a married homeowner with a toddler and a baby on the way.

Kayaking at the Kennedy Center in DC

I work for a university and absolutely love being in a learning environment every day.

2. How long have you been reading The Frugal Girl?

I’ve been reading The Frugal Girl for a few years, ever since the Non-Consumer Advocate linked to Kristen’s blog.

3. How did you get interested in saving money?

My parents were both parochial schoolteachers when I was growing up, so we never had a lot of money. I remember getting my first job out of college and the salary was more than my mom had made after 30 years of teaching.

At the Museum of Islamic Art in Doha

Despite that, we always had an open door policy for anyone that needed a place to stay or a meal to share. I grew up with a large extended family nearby (60 first cousins) so we lived in a very communal way that never made us feel like we went without.

4. What’s the “why” behind your money-saving efforts?

A few years out of college I found myself in a relationship with someone that had very different spending habits and the relationship put me into credit card debt.

After leaving the relationship and spending a few years digging myself out of that financial hole, I vowed never again to let someone else have control my financial decisions.

Now, I think my interest in saving money is a combination of wanting to put my resources into areas that feel truly meaningful to me and my family and an appreciation that frugality and environmentalism often go hand in hand.

As a Midwesterner, I can also never pass up telling someone what a great deal I was able to get on something 😊.

5. What’s your best frugal win?

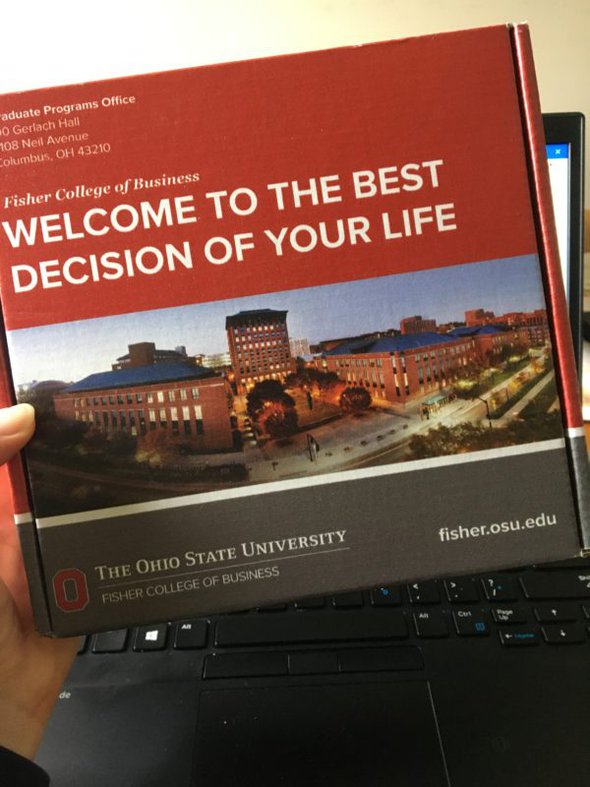

When I started my job at the university I took advantage of education benefits and will graduate with my MBA this winter.

While I’ve had to pay some money toward the course fees, I essentially got a $90k degree for about $10k. I don’t expect the degree to pay off immediately, but I do think over my lifetime it will pay itself back many times over.

6. What’s an embarrassing money mistake you’ve made?

Right about the time we were getting married, I read a story about the largest cat sanctuary in North America and decided it needed to be a stop on our honeymoon journey.

In retrospect, it was far away, costly to get there, and the cats were pretty dirty. While the rest of the honeymoon was outstanding, my insistence on seeing feral cats should have been avoided. It did make for some great photos though.

7. What’s one thing you splurge on?

Quality food. I receive a CSA box weekly with produce from local farms.

homemade pasta and sauce

It is a bit pricier than shopping at the grocery store, but I believe in supporting local agriculture and enjoy the new-to-me fruits and vegetables that encourage me to be creative in my cooking.

Plum and ground cherry tart

I love to cook and will always try to find quality ingredients. I especially love to try to recreate recipes from places I’ve traveled.

homemade khachapuri.

8. What’s one thing you aren’t remotely tempted to splurge on?

Purses, brand name clothing, pedicures, manicures, housewares (looking at you Homegoods), etc. I like to keep my wardrobe and housewares simple and meaningful.

9. If $1000 was dropped into your lap today, what would you do with it?

My husband and I currently pay more for daycare each month than we do for our mortgage. With our baby arriving this fall, these costs will double. An extra $1,000 would be very helpful for daycare expenses, although, unfortunately, would barely make a dent.

10. What’s the easiest/hardest part of being frugal?

Easiest: As the parent of a toddler, we don’t go out to eat much these days, and we spend a lot of time at parks, splash pads and other free/cheap outdoor activities.

We also spend a lot of time at home and recently made some DIY upgrades to our backyard, like a new fire pit area.

Hardest: The hardest part of being frugal is having anything you want at your fingertips with Amazon, Target, Walmart, etc. It’s easier and faster to buy my daughter a new outfit with one click than to go through my local thrift or secondhand shops.

I have to intentionally carve out time, plan ahead, and be patient to find the things I need.

11. Is there anything unique about frugal living in your area?

We have fantastic library and metro parks systems and we’re known for our hundreds of summer festivals.

12. How has reading the Frugal Girl changed you?

I love the community Kristen has curated of people that appreciate frugality (whatever that means to them), gratitude, living simply, and being focused on finding the good in every day. When I see a new blog post come up it feels like a small delight in my day.

13. What frugal tips have you tried and abandoned?

Homemade deodorant and laundry soap have been the two biggest failures.

Both were underwhelming and time-consuming and the deodorant stained my clothing. At this point in my life, I carefully consider the time cost/benefit of frugal activities.

Maybe someday I will have more time to explore homemade items, but for now, I look for sustainable products that align with my environmental and budget goals.

14. What single action or decision has saved you the most money over your life?

Marrying my current husband. We have very similar financial goals and spending habits, which makes our money conversations easy.

While he also made early money mistakes (like $130,000 in graduate school debt), he has worked hard to get those debts forgiven and we’re clear-eyed about what money we have and what we can spend.

__________________

Oh man, I feel you on the homemade laundry soap! I tried that too, many years ago, and it was an abject failure. My clothes all started to smell like stinky feet. I will never, ever try that again; inexpensive commercial laundry detergent is totally worth it to me.

The food pictures you sent in are so beautiful and inspiring! I’m impressed you find the time to do things like make homemade pasta with a toddler, a job, and being in school yourself.

Your little girl is so precious (her sweet little shoes in the library photo made me smile) and I loved your cat sanctuary photo. The cats are charming, and your dress is lovely!

The first time I got married, I would not have considered a cat sanctuary on a honeymoon, but if I got married again, I definitely would. How things change! 🙂